21 Which of the Following Represents Intangible Capital

The required rate of return is 8 percent. 72 The elimination of leaded gasoline resulted in.

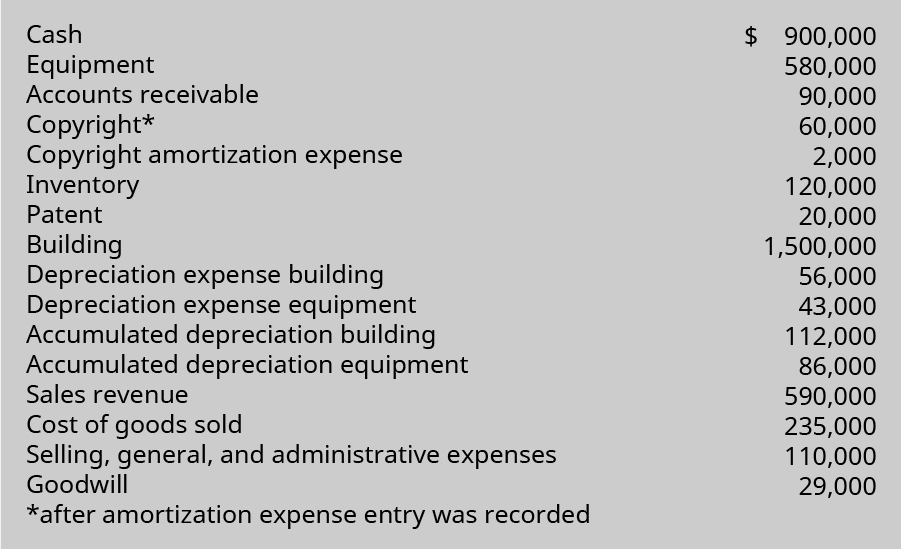

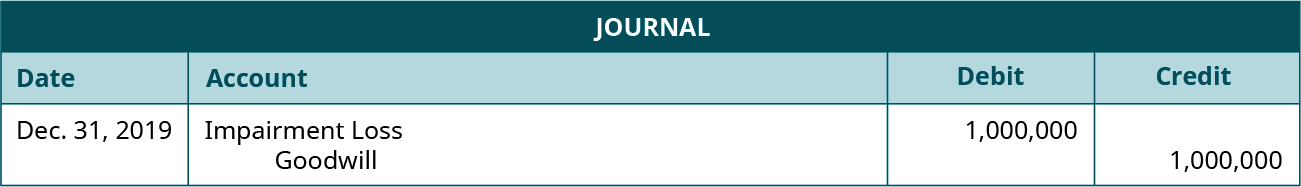

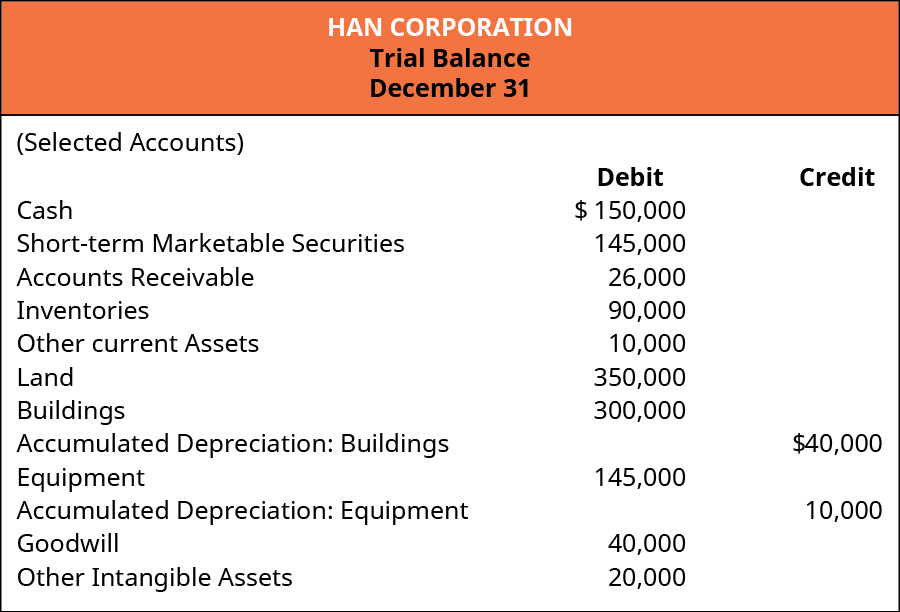

Describe Accounting For Intangible Assets And Record Related Transactions Principles Of Accounting Volume 1 Financial Accounting

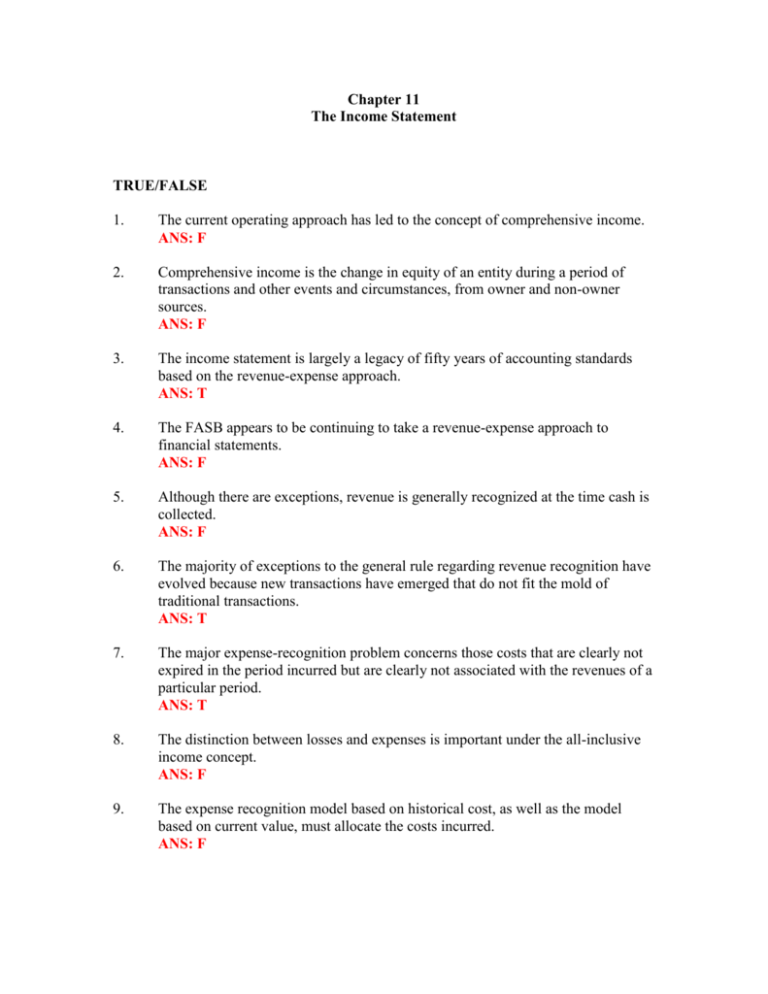

Refer to section 21 AACSB.

. Must be short lived and tangible D. Reliable measurement of cost. Intangible capital assets are included in which CCA.

The shift to a knowledge economy has been underway for decades. A produced capital B human capital C social capital D knowledge assets 9 Energy is lost as it moves from one trophic level to the next because. A one trophic level does not consume the.

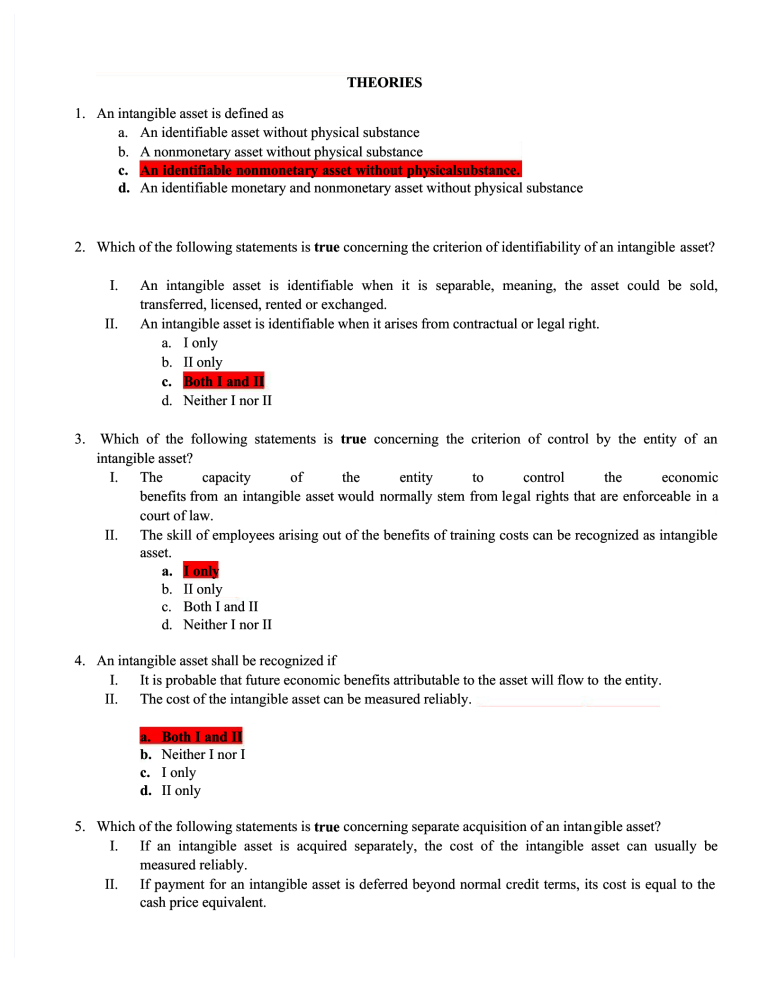

A patent with a remaining legal life of twelve years is bought and Hanna expects to be able to use it for six years. Group of answer choices A. INTANGIBLE CAPITAL IC This is a phrase and a concept that comes out of the study of intangibles in an organization.

21 Intellectual capital refers to ________. June 21 2021 by Prasanna. It takes people beyond the strict definitions found in accounting and takes a fresh look at what is going on.

Basically the rise of the importance of intangibles is part of the story of the end of the industrial economy and the. Must be long lived and used by the company in its normal operations C. 6 Which of the following is not an element of intangible capital.

73 Over about the past 25 years the US population has risen by 33 the number of vehicle miles driven has more than doubled and. An intangible asset is recognised at cost IAS 3824. The following are examples of constructive receipts except.

Financial Statements Interpretation Corporate and Management Accounting MCQ. Which of the following are criteria for determining whether to record an asset as a fixed asset. It is estimated that 70 of the value of the average company today is intangible and depends on invisible assets like personal networks company reputation or capacity to innovate.

Gain on sale of real property -. Are difficult to quantify. A global network of organizations and activities that supply a firm with goods and services is referred to as.

A the intangible assets and resources of an enterprise. They are financial instruments. Must be tangible and an investment.

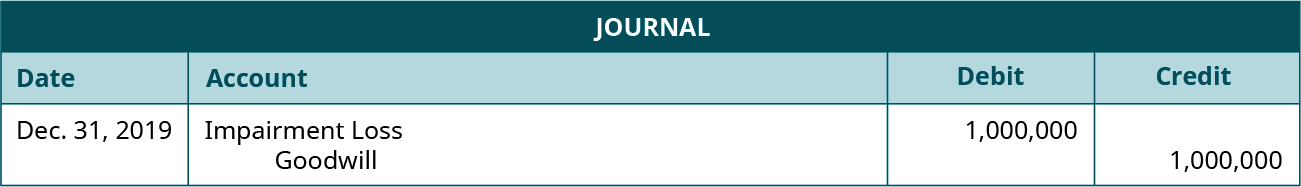

Must be an investment and long lived B. ___ Gross working capital represents the total investment in assets. Property that is goodwill or was considered eligible capital property prior to January.

An intangible asset is recognised when it meets all of the criteria below IAS 381821. Choose the correct answer. Classes for income tax.

It is purchased at a cost of 48000. The following intangible assets were purchased by Hanna Unlimited. Which of these is NOT one of the basic functions of the management process.

B the average levels of lead in the blood of children have declined by 90. IAS 38 provides application guidance for separate acquisition of intangible assets and acquisition as part of a business combination. A Loss of capital natures.

Under which of the following circumstances the fixed capital requirement of a business is not likely to be high. Are often ignored in capital budgeting decisions. A Current b Fixed c Tangible d Intangible.

Human capital is said to include qualities like an employees experience and skills. Royalties - place of use of intangible d. Contra accounts must be reported for intangible assets in a manner similar to accumu- lated depreciation and property plant and equipment.

100 of inventory which is sold today on credit for 103 C. They provide long-term benefits. They lack physical existence.

2-1 Ross - Chapter 02 17 Section. A expense account B temporary account C permanent account D revenue account 21 The entries that transfer the revenue expense and Owner Withdrawals balances to the Owner Capital account to prepare the companys books. Which of the following does not represent a pair of GAAP IFRS-comparable termsa Additional paid-in capitalShare premiumb Treasury stockRepurchase reservec Common stockShare capitalordinaryd Preferred stockPreference shares.

1 2017 is included in Class 141. Which of the following does not describe intangible assets. Since all labor is not considered equal employers can improve human capital by investing in the training education and benefits of their employees.

NPV IRR A 190 5 109 B 190 5 260 C 337 9 109 35. Income from services - place of performance c. Which one of the following represents the most liquid asset.

C a benefit to cost ratio of at least 10 to 1. All of the following statements about intangible benefits in capital budgeting are correct except that they a. Include increased quality and employee loyalty.

As per Section 198 of the Companies Act 2013 while calculating net profit for managerial remuneration if gross profit is the starting point then which of the following is allowed to deduct. Yet when most managers go to work in the morning they use tools optimized for industrial organizations and tangible. Which of the following test of source of income is incorrect.

A When the raw material is not easily available. Classes 10 and 101. D the assets belonging to an enterprise that are freely available to the public.

Net working capital 8. 100 account receivable that is discounted and collected for 96 today B. Given the following cash flows for a capital project calculate the NPV and IRR.

B the assets that do not contribute to an organizations profitability. Classes 14 and 141. Human capital is an intangible asset not listed on a companys balance sheet.

D Intangible assets include the exclusive right to produce or sell an invention 20 An account that is NOT closed at the end of the period is called an. C the assets of an organization that can be sold to another organization. Interest income - residence of the debtor b.

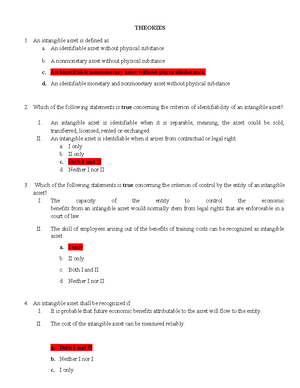

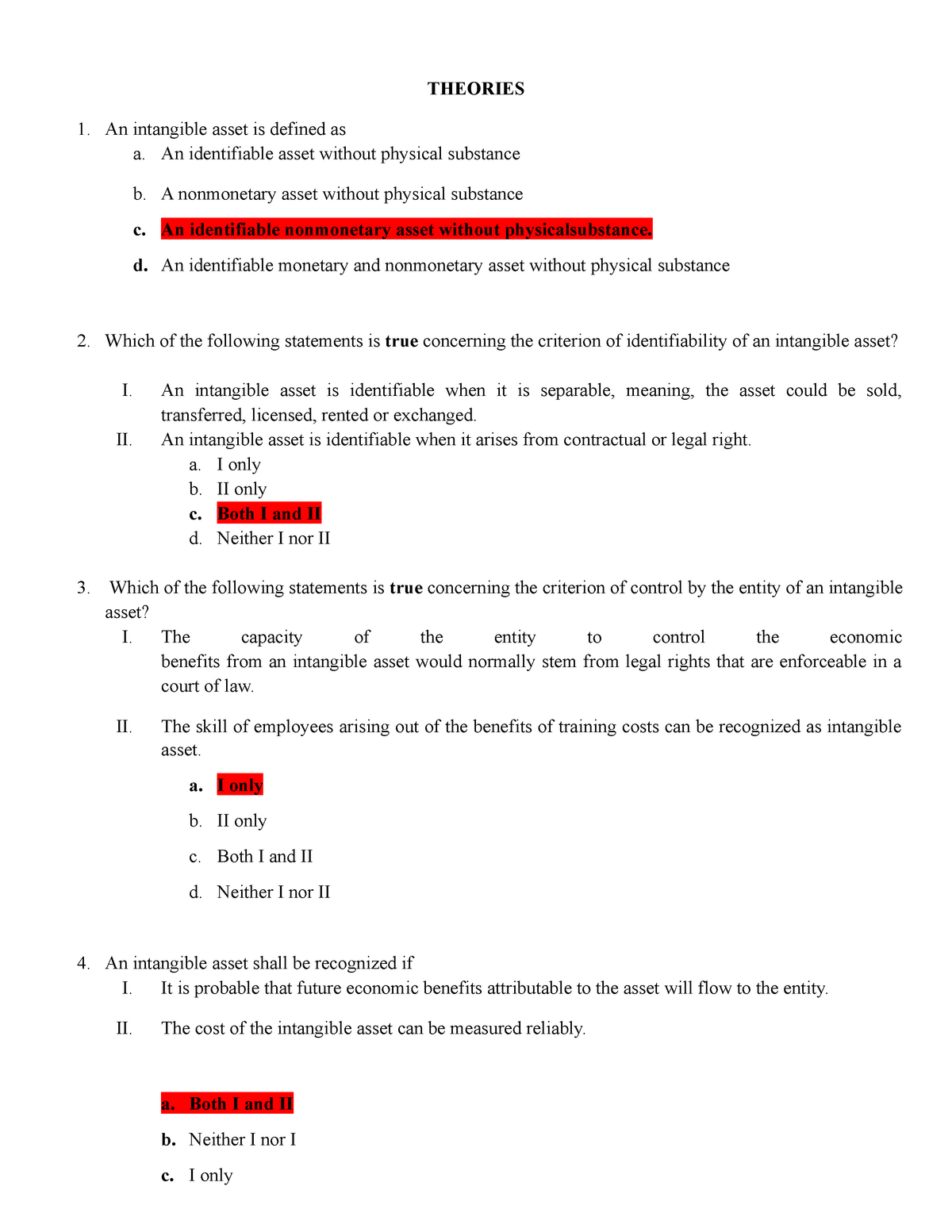

431307622 Intangible Asset Theories An Intangible Asset Is Defined As A An Identifiable Asset Studocu

431307622 Intangible Asset Theories An Intangible Asset Is Defined As A An Identifiable Asset Studocu

:max_bytes(150000):strip_icc()/ScreenShot2022-03-30at6.20.03PM-3d8c5a8e9fd540e59f17dea67ced8469.png)

Tangible Assets Vs Intangible Assets What S The Difference

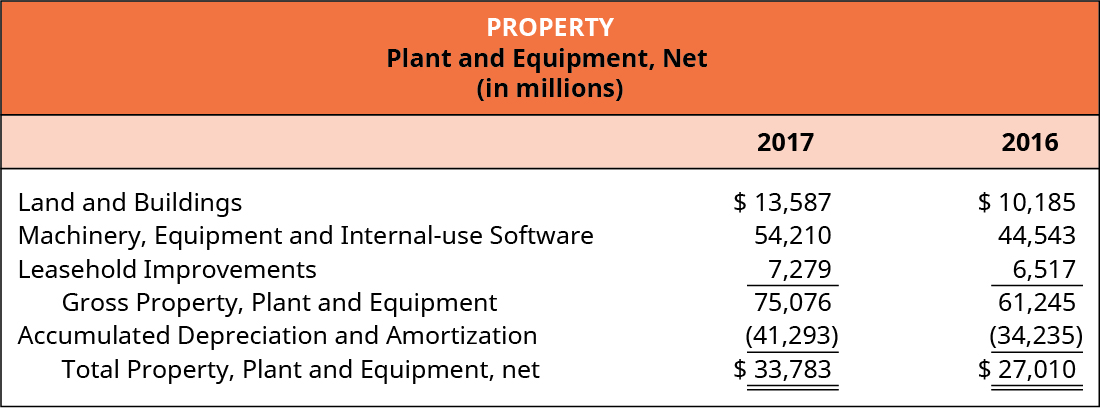

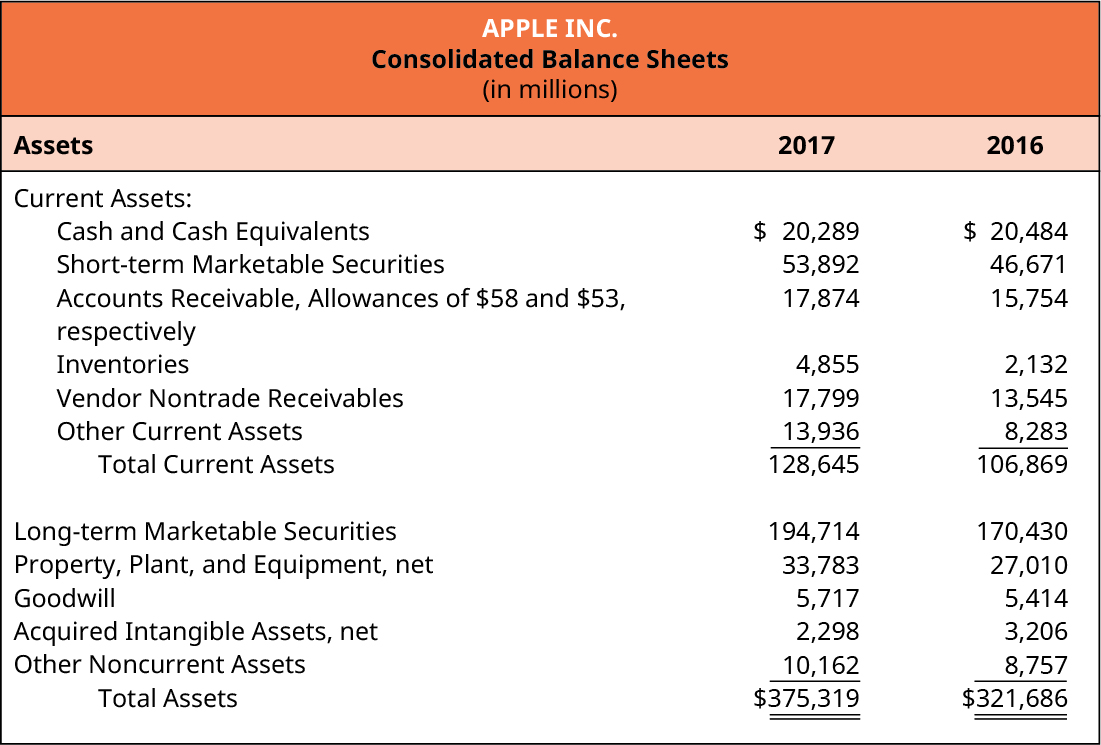

Distinguish Between Tangible And Intangible Assets Principles Of Accounting Volume 1 Financial Accounting

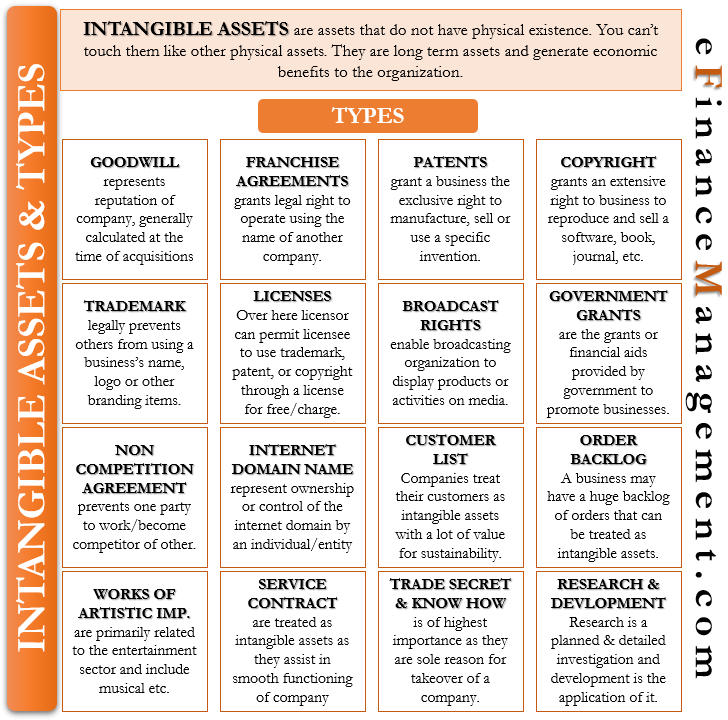

16 Types Of Intangible Assets Each Explained In Brief Efm

Intangible Asset Pdf Goodwill Accounting Intangible Asset

/ScreenShot2022-03-30at6.20.03PM-3d8c5a8e9fd540e59f17dea67ced8469.png)

Tangible Assets Vs Intangible Assets What S The Difference

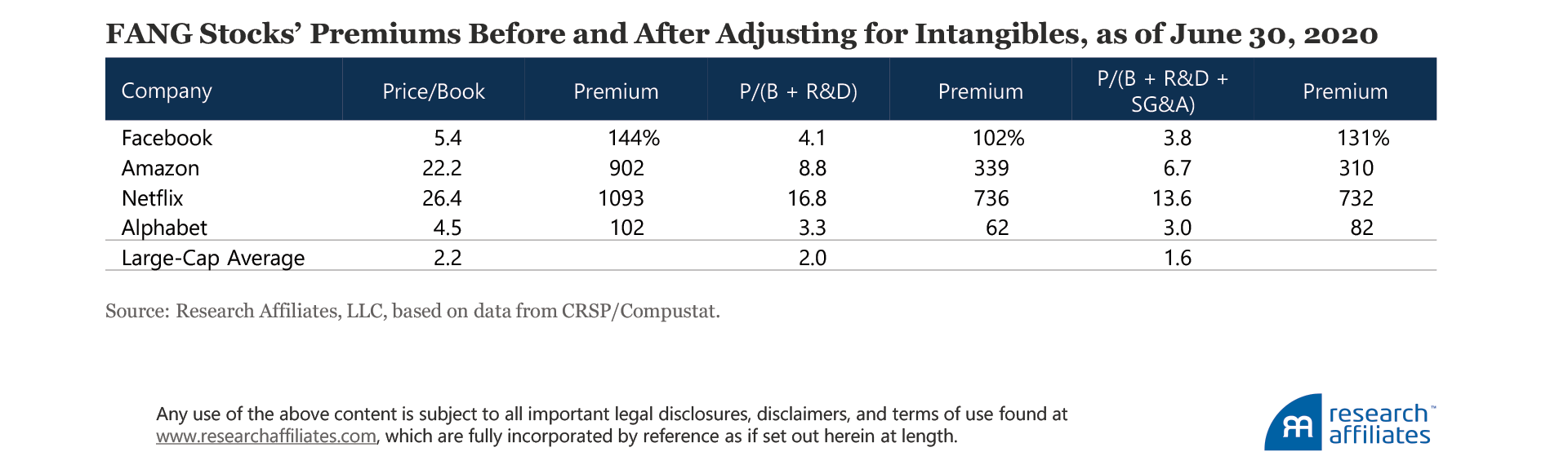

Book Value Is An Incomplete Measure Of Firm Size Research Affiliates

Distinguish Between Tangible And Intangible Assets Principles Of Accounting Volume 1 Financial Accounting

:max_bytes(150000):strip_icc()/Walmart202010KIncomestatement-365d4a49671b4579a2e102762ada8029.jpg)

Operating Income Before Depreciation And Amortization Oibda Definition

/ScreenShot2022-03-30at6.20.03PM-3d8c5a8e9fd540e59f17dea67ced8469.png)

Tangible Assets Vs Intangible Assets What S The Difference

/ScreenShot2022-03-30at6.20.03PM-3d8c5a8e9fd540e59f17dea67ced8469.png)

Tangible Assets Vs Intangible Assets What S The Difference

Distinguish Between Tangible And Intangible Assets Principles Of Accounting Volume 1 Financial Accounting

338007366 21 Intangible Assets

Describe Accounting For Intangible Assets And Record Related Transactions Principles Of Accounting Volume 1 Financial Accounting

/ScreenShot2021-08-21at5.02.29PM-f5d77e3185ff4122a026ba2a6c89c6de.png)

Comments

Post a Comment